Crowds walk below neon signs on Nanjing Road. The street is the main shopping district of the city and one of the world’s busiest shopping districts.

Nikada | E+ | Getty Images

The International Monetary Fund on Tuesday slightly raised its global growth forecast, saying the economy had proven “surprisingly resilient” despite inflationary pressures and monetary policy shifts.

The IMF now expects global growth of 3.2% in 2024, up by a modest 0.1 percentage point from its earlier January forecast, and in line with the growth projection for 2023. Growth is then expected to expand at the same pace of 3.2% in 2025.

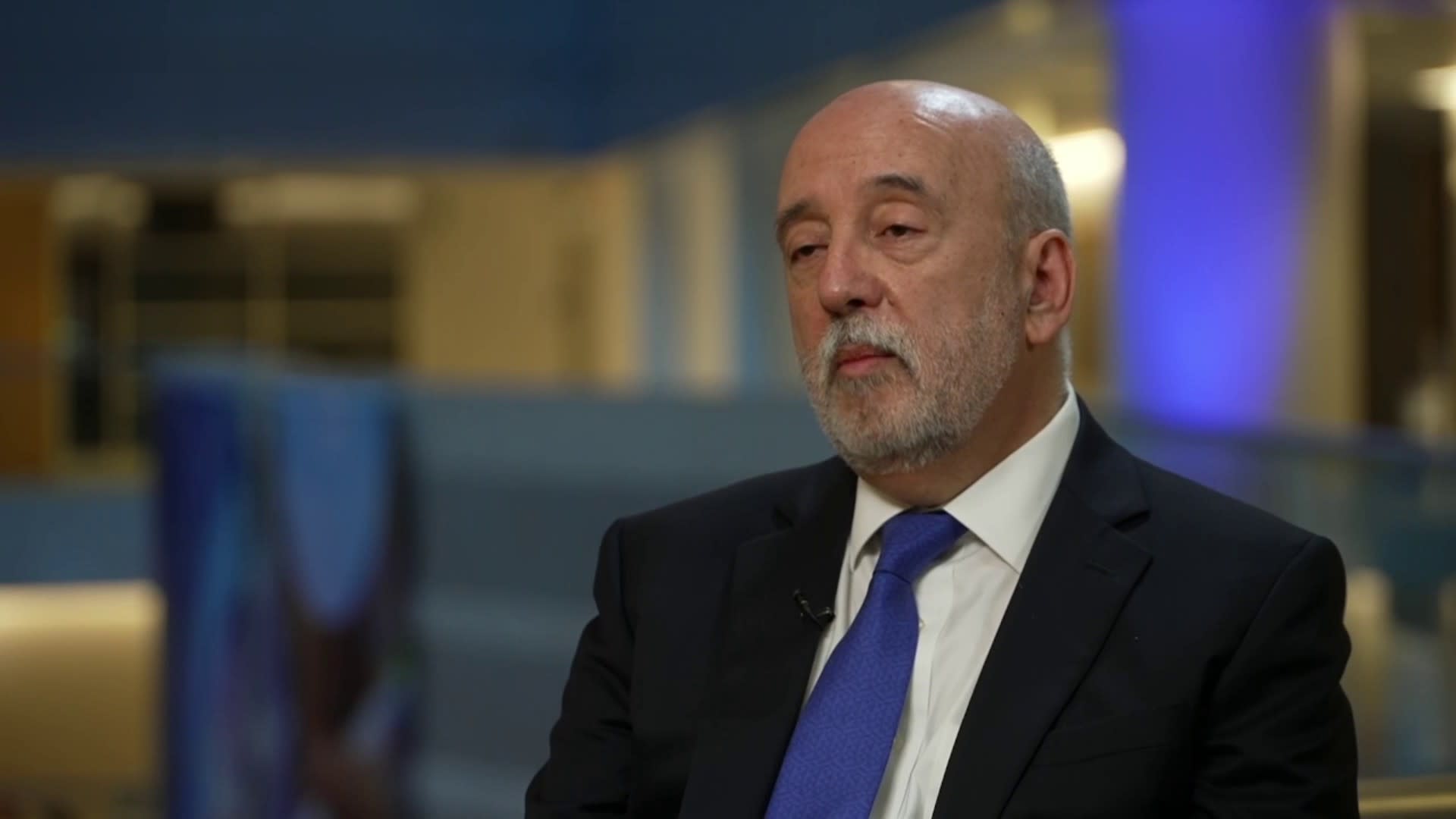

The IMF’s chief economist, Pierre-Olivier Gourinchas, said the findings suggest that the global economy is heading for a “soft landing,” following a string of economic crises, and that the risks to the outlook were now broadly balanced.

“Despite gloomy predictions, the global economy remains remarkably resilient, with steady growth and inflation slowing almost as quickly as it rose,” he said in a blog post.

Growth is set to be led by advanced economies, with the U.S. already exceeding its pre-Covid-19 pandemic trend and with the euro zone showing strong signs of recovery. But dimmer prospects in China and other large emerging market economies could weigh on global trade partners, the report said.

China among key downside risks

China, whose economy remains weakened by a downturn in its property market, was cited among a series of potential downside risks facing the global economy. Also included were price spikes prompted by geopolitical concerns, trade tensions, a divergence in disinflation paths among major economies and prolonged high interest rates.

To the upside, looser fiscal policy, falling inflation and advancements in artificial intelligence were cited as potential growth drivers.

Central banks are now being closely watched for a signal on the future path of inflation, with opinion diverging on either side of the Atlantic as to when the Federal Reserve and the European Central Bank will cut rates. Some analysts have recently forecast a possible Fed rate hike as stubborn inflation and rising Middle East tensions weigh on economic sentiment.

The IMF said it sees global headline inflation falling from an annual average of 6.8% in 2023 to 5.9% in 2024 and 4.5% in 2025, with advanced economies returning to their inflation targets sooner than emerging market and developing economies.

“As the global economy approaches a soft landing, the near-term priority for central banks is to ensure that inflation touches down smoothly, by neither easing policies prematurely nor delaying too long and causing target undershoots,” Gourinchas said.

“At the same time, as central banks take a less restrictive stance, a renewed focus on implementing medium-term fiscal consolidation to rebuild room for budgetary maneuver and priority investments, and to ensure debt sustainability, is in order,” he added.

Despite the rosier outlook of Tuesday, global growth remains low by historic standards, owing in part to weak productivity growth and increasing geopolitical fragmentation. The IMF’s five-year forecast sees global growth at 3.1%, its lowest level in decades.